March 2023 Scorecard

- catherine2042

- Apr 14, 2023

- 2 min read

Anchor Pacific’s March 2023 investment scorecard. See asset class performance, 3-year asset class risk and return, macro summary (key index levels and rates), and yield curves.

To download the complete Monthly Investment Scorecard, please click on the link below:

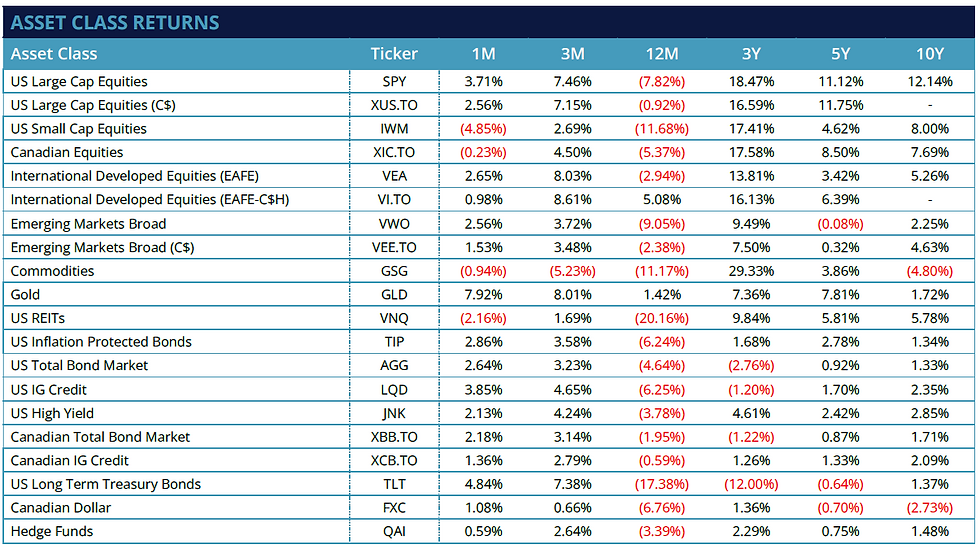

Summary of Returns

Month-over-Month

Positive returns for 16 of 20 asset classes

Top 3

Gold 7.92% | US Long Term Treasury Bonds 4.84% | US IG Credit 3.85%

Bottom 3

US Small Cap Equities (4.85%) | US REITs (2.16%) | Commodities (0.94%)

Canadian Markets

Equities (0.23%)| Bonds 2.18% | IG Credit 1.36% | CAD 1.08%

Past 3 months

Positive returns for 19 of 20 asset classes

Top 3

International Developed Equities (EAFE) 8.03% | Gold 8.01% | US Large Cap Equities 7.46%

Bottom 3

Commodities (5.23%) | Canadian Dollar 0.66% | US REITs 1.69%

Canadian Markets

Equities 4.50% | Bonds 3.14% | IG Credit 2.79% | CAD 0.66%

Past 12 months

Positive returns for 2 of 20 asset classes

Top 3

International Developed Equities (EAFE-C$H) 5.08% | Gold 1.42% | Canadian IG Credit (0.59%)

Bottom 3

US REITs (20.16%) | US Long Term Treasury Bonds (17.38%) | US Small Cap Equities (11.68%)

Canadian Markets

Equities (5.37%) | Bonds (1.95%) | IG Credit (0.59%) | CAD (6.76%)

Macro Summary (Key Index Levels and Rates)

US Yields

10 year Government 3.48% (44 bps lower)

30 year Government 3.67% (26 bps lower)

Yield Curve (3m-10y) (137 bps) (further inverted by 41 bps)

High Yield spread 458 bps (wider by 36 bps)

Volatility (VIX): 18.70 ( (9.66%) M-O-M, (13.71%) from 3 months ago)

Oil: $75.67 ( (1.79%) M-O-M, (5.96%) from 3 months ago)

Gold: $1,969.00 (6.25% M-O-M, 6.88% from 3 months ago)

USD / EURO: € 0.92 (Euro stronger by 2.42% M-O-M, stronger by 1.26% from 3 months ago)

USD / Yen: ¥132.79 (Yen stronger by 2.50% M-O-M, weaker by 1.28% from 3 months ago)

*Information above is from 2023.03 Investment Scorecard

Comments